As the new SSS law takes effect on March 5, nonprofit labor organization Ecumenical Institute for Labor Education and Research, Inc. (EILER) says that new combined monthly members contributions rate will increase by 62.91% in 2025, for basic salary of at least P10,000 a month*. For those employed and earning within the said salary floor, this means that the P488.30 deductions would be P795.50 in 2025, because of the P307.70 total increases.

Table 1: Deduction for employees earning P10,000 a month (in Pesos)

2017 deduction | 2025 deduction | Increase | |

SSS | 363.30 | 545.50 | +182.70 |

PhilHealth | 125 | 250 | +125 |

Combined | 488.30 | 795.50 | +307.70 |

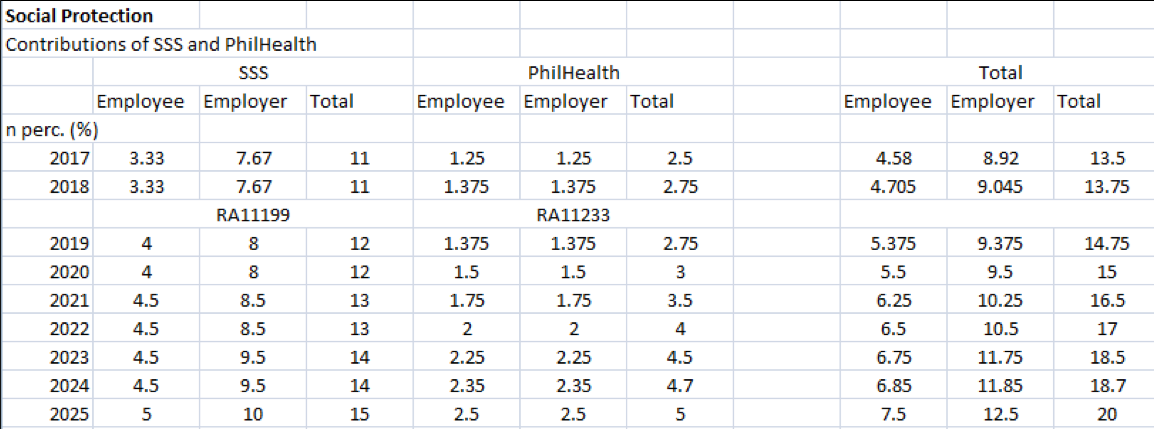

For the employed members, this is shared with the employer (total of 20%). The combined contribution hike is 6.5 percentage points higher (an increase of 48.15%) from the 2017 rate of the members contributions for their social protection (social security and health), as indicated in the table below.

Table 2: Increase of contributions of SSS and Phil Health from 2017 to 2025 (in %)

For freelancers and self-employed (SE) and other members of the informal economy, the contribution and increases are solely carried by the individually paying member. This means premium contribution of at least P1,500 for SSS and P200 for PhilHealth by 2025. That’s a total of P1,700 per month, should the member choose to settle premiums per monthly basis.

Table 3: Contribute rates for self-employed earning P10,000 a month (in Pesos)

2017 | 2025 | Increase | |

SSS | 1,100 | 1,500 | +400 |

PhilHealth | 200 | 200 | +0 |

Combined | 1,300 | 1,700 | +400 |

EILER noted that in 2017, President Rodrigo Duterte approved the P1,000-pension hike in January with a corresponding 1.5% contribution rate hike in May of the same year, and an increase in monthly salary credit to P20,000 from P16,000.

Under the Social Security Act of 2019 (RA 11199), the Social Security Commission has the power to raise contribution rates even without the President’s approval, on top of the mandated 1 percentage point increase every two years until 2025. Meanwhile, Universal Health Care Act (RA 11233) IRR is pending.

“Financing social protection should protect and uplift the poor, not burden them with further economic insecurities. The new developments under RA 11199 and RA 11233 are neoliberal economic prescriptions that further deregulate and privatize our social security and health insurance to accumulate more capital and invest in the free market. It is extreme injustice to make it harder for the working people and the poor to access poverty alleviation mechanisms,” EILER Executive Director Rochelle Porras said in a statement on Tuesday.

According to EILER, despite the steep increases, there is no significant wage increase included to augment the added deductions for SSS and PhilHealth contributions. The implementation of RA 10963 or the Tax Reform for Acceleration and Inclusion (TRAIN) which fueled higher inflation and higher costs of goods and services have made minimum wage earners and informal workers more vulnerable and less able to emerge from poverty. Now they have to face up to year 2025 increased deductions.

“We’d like to ask: what do we get from this increased contribution apart from lower take home pay? Right now, it’s very clear that we will get conditional unemployment benefits of 50% our average monthly salary credit for 2 months; expanded maternity leave from 60 to 105 days, which still has to be paid with further increase of members contribution and not from increased budget allocation for social services; the elderly are also denied the second tranche of P1,000 pension hike this year. The increase in premiums does little to assure us that social spending is even a priority of this administration,” Porras added.

EILER lauded the employees, employers and individual members who are remitting faithfully to SSS and PhilHealth in spite of the many complaints about the services. The labor NGO stressed that it is unfair to blame the short fund life of the state insurance systems to contributing members.

“There are other means to extend the fund lives of the SSS and PhilHealth. First, increase government budget allocation for social services. For SSS, why not go after the erring employers who do not report and remit? Despite claims of limited pension funds, SSS has managed to increase its revenue by 6 percent to P212.6 Billion in 2018. Members’ contributions which comprises a huge chunk of the agency’s total revenues increased by 13.89 percent. It shows that if it continues to improve its dismal collection efficiency rate, more importantly to penalize employers who have failed to remit billions of pesos in premiums, contribution increase is not necessary,” Porras said.

EILER emphasized that genuine structural and economic reforms are important to combat cuts on government spending on social protection.

#

*P10,000/month was used in the statement as this is the current income floor for PhilHealth direct contributors.